Automatic Mileage Tracking

Never Miss A Trip

How it works

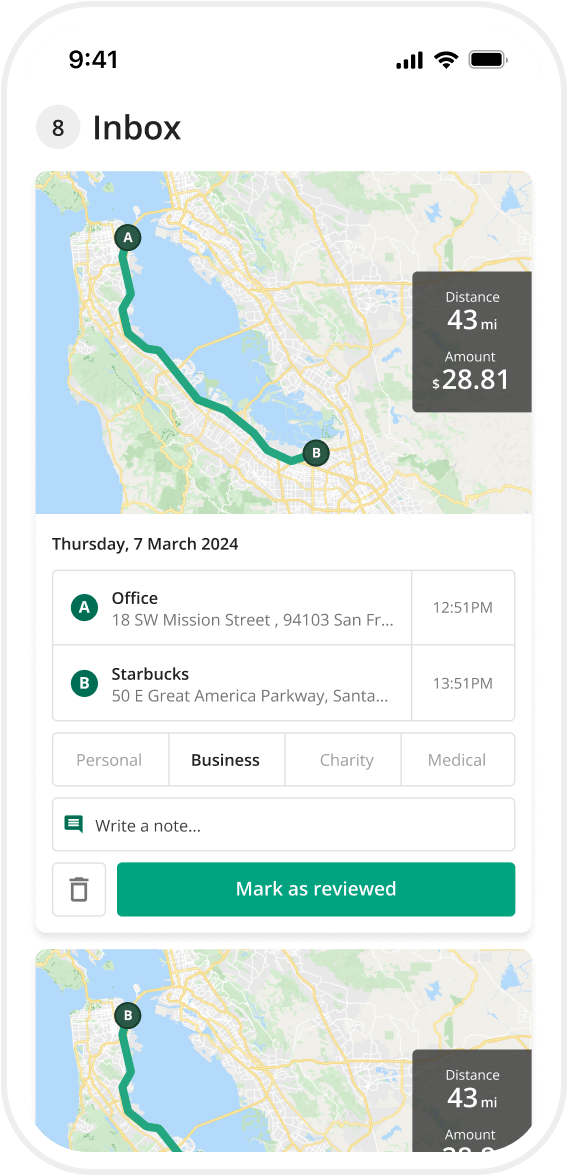

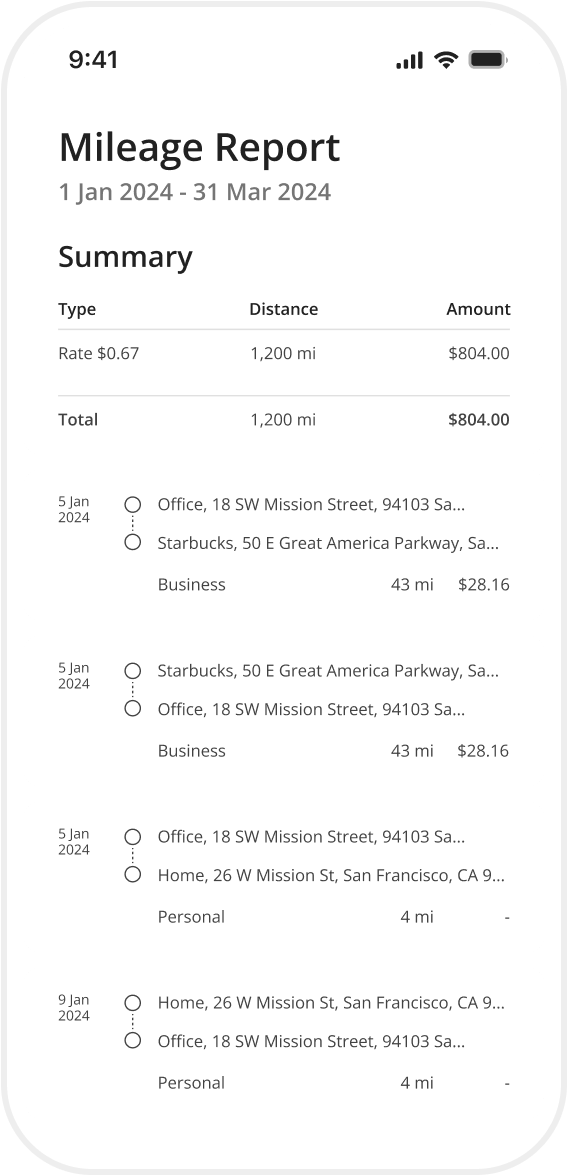

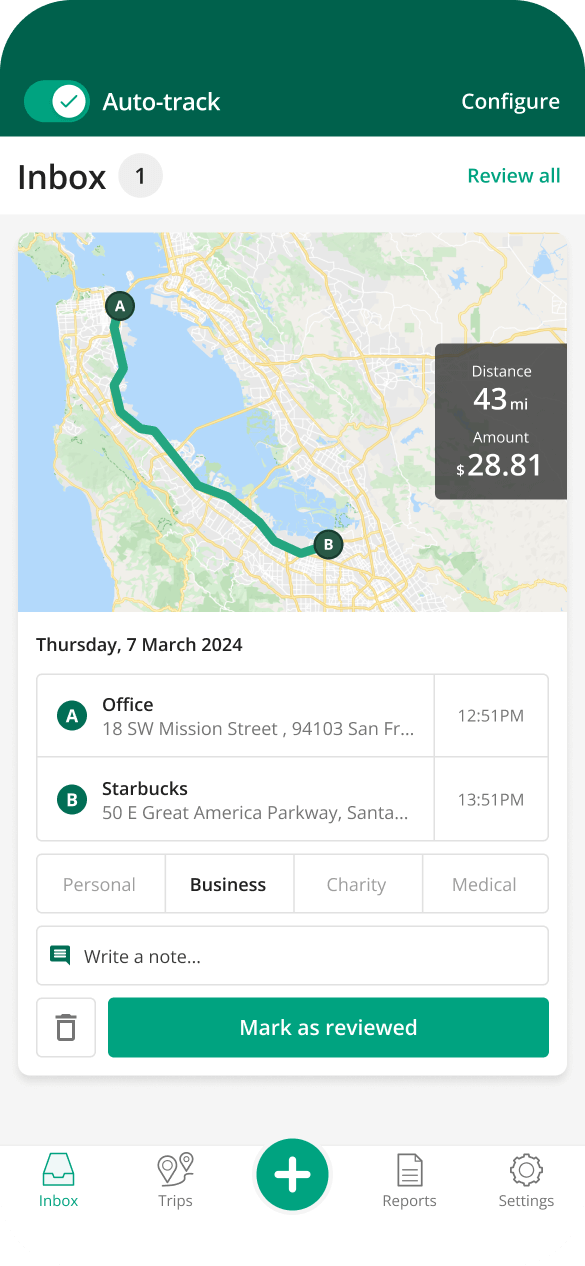

Mileage logging made easy

Driversnote makes mileage tracking super easy with automated trip logging, intelligent classification, and instant mileage reports.

Even easier & more accurate auto-tracking with iBeacon

Automatically record the trips you take in your vehicle and avoid tracking journeys where you are a passenger, on your bicycle or using public transport. You’ll also save time reviewing trips and use less phone battery.

Top posts

For Self-Employed

Latest update: November 28, 2025 - 10 min read

Learn what goes into claiming mileage tax deduction as self-employed, the methods you can use and what records to keep.

How to Keep an IRS-Compliant Mileage Log

Latest update: December 9, 2025 - 2 min read

Keep a tax-compliant log book for taxes. Learn what your mileage log book should include and keep up with all IRS rules and requirements.

Calculate Your Reimbursement

Latest update: February 24, 2025 - 5 min read

Learn how to calculate your mileage for reimbursements or tax deductions in 2025. Simple examples and a calculator to help you get started.