How to automate your mileage log book

Keeping a mileage log book has never been easier. Track your mileage automatically and quickly create and share mileage logs for your reimbursement or deductions.

How to automatically track mileage

Mileage tracking made easy

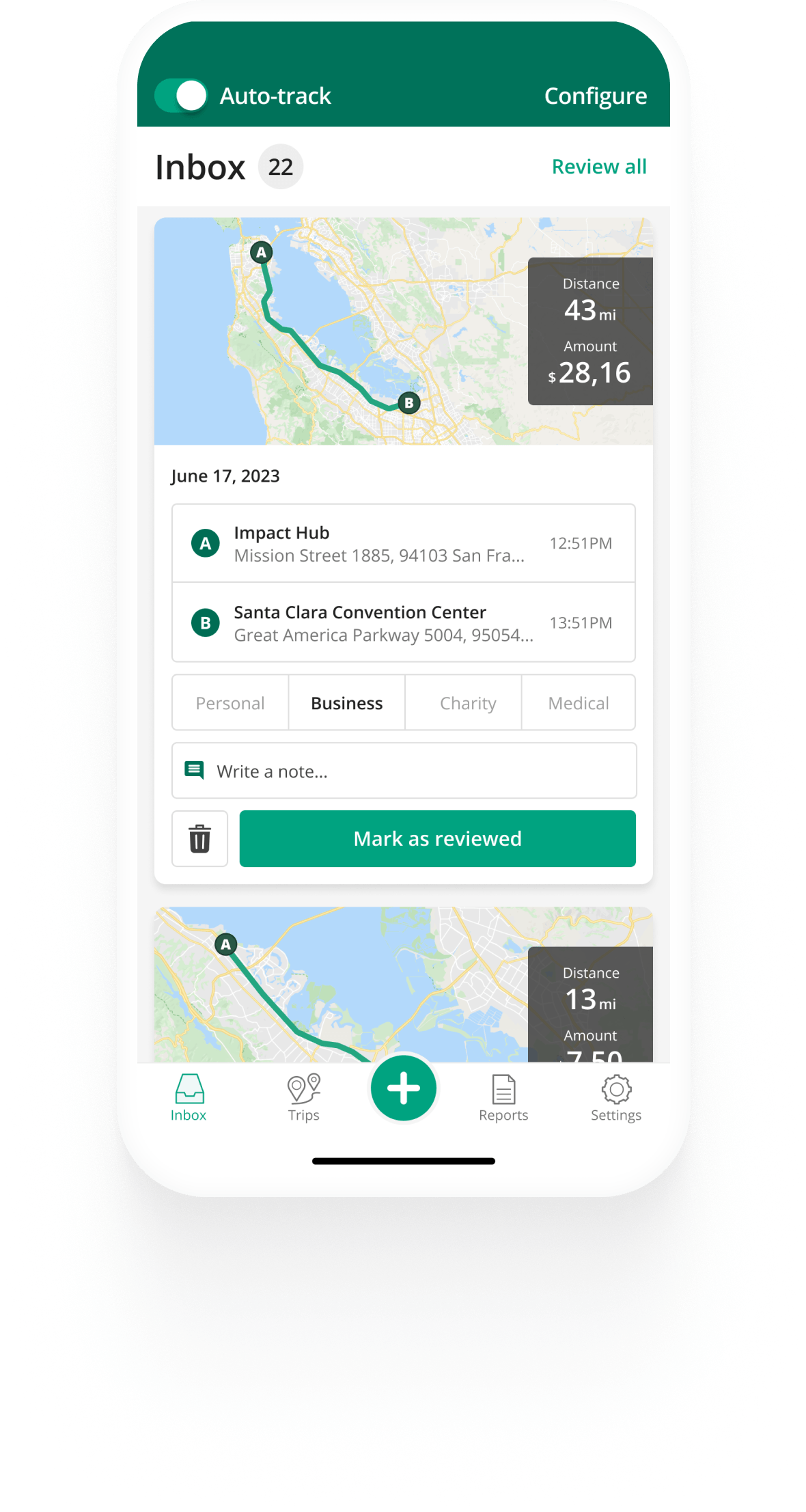

Use the Driversnote mileage log app to track trips automatically - no need to even open the app. We will log all the required information for you and calculate your reimbursement. You can always add or edit trip details later on.

Read more Sign upIntelligent classification of your trips

Business or Personal?

Stay IRS compliant by logging your mileage under the correct category. Review and classify your trips as Business or Personal in a simple overview. Add your working hours to the app and we will even classify your trips automatically.

Read more Sign upWhat our customers say about us

Driver Excellent

Great app! Super easy to use. Thank you.

easy.

Great tool I wish I knew about this app last year. Definitely would’ve come in handy to help with taxes this year.

it's easy to use thanks

Easy to set up after downloading. Very easy as once set up it works automatically.

Great tool I wish I knew about this app last year. Definitely would’ve come in handy to help with taxes this year.

it's easy to use thanks

Easy to set up after downloading. Very easy as once set up it works automatically.

Just what I've been looking for to track my charitable driving trips!

A great app.

Is the app perfect, no. But it certainly makes mileage tracking much esier than doing it the old fashioned way. I can easily get a report based on my needs. Their customer service is easily accessible and very helpful. I would recommend.

Just what I've been looking for to track my charitable driving trips!

A great app.

Is the app perfect, no. But it certainly makes mileage tracking much esier than doing it the old fashioned way. I can easily get a report based on my needs. Their customer service is easily accessible and very helpful. I would recommend.

Frequently Asked Questions

A mileage log is a record of the distances traveled by a vehicle for business or tax purposes. The purpose of a mileage log is to provide an accurate record of all the trips for business purposes, such as meetings with clients, site visits, or travel to a work-related event. Use your mileage log to claim tax deductions, reimbursements from an employer, or to bill clients for travel expenses.

To create a mileage log, you should document the mileage traveled for each trip, along with the date, destination, purpose, and other relevant information. We recommend trying a mileage log app for faster mileage log creation.

Individuals who use their personal vehicles for business purposes and receive reimbursement or claim tax deductions are typically required to keep a mileage log. This includes self-employed individuals, independent contractors, and employees who receive reimbursement for their mileage expenses from work.

Get started for free

Never miss a trip

We've got you covered, and it's easy to get started, and even easier to keep going.